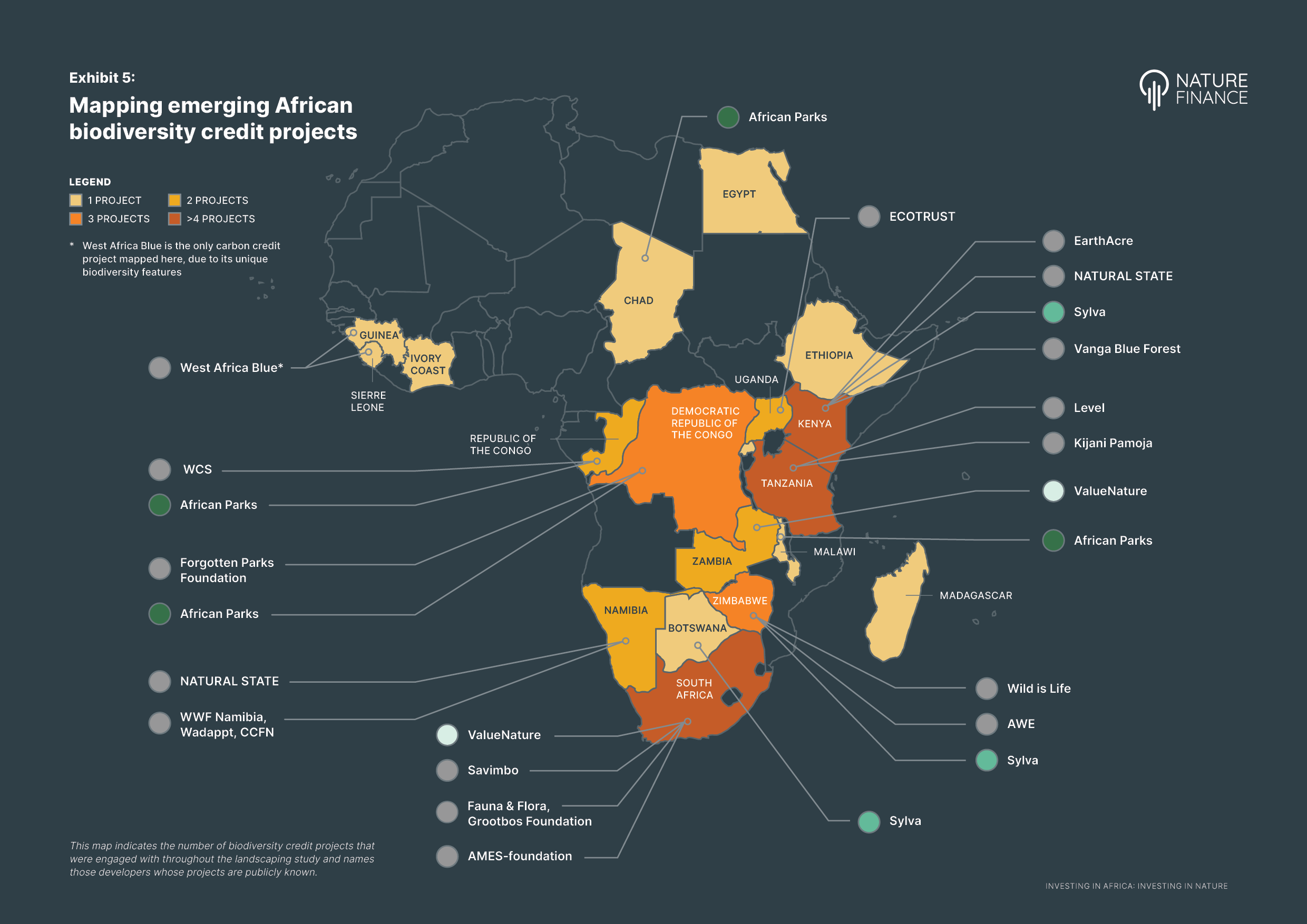

In collaboration with NatureFinance, we bring you this comprehensive study on the rise of biodiversity credit projects across the African continent. Through in-depth research conducted over six months and interviews with nearly 100 stakeholders, the report identifies over 30 biodiversity credit projects driving innovation in Africa’s nature finance landscape.

The study reveals a dynamic ecosystem of players—IPLC coalitions, project developers, government bodies, NGOs, investors, and academics—working together to unlock the potential of biodiversity credits. These credits are crucial for attracting private investment that supports sustainable conservation and restoration efforts across the continent.

Key insights from the study include:

In addition, the study outlines six recommendations and presents three possible scenarios for biodiversity credit market development in Africa. These scenarios range from community-led approaches to globalized markets, each with profound implications for Africa’s biodiversity and the broader nature finance ecosystem.

Biodiversity credits, while still evolving, hold the promise of driving nature-positive investments that safeguard Africa’s rich natural heritage.